Local Apps on ChaGPT, AI Fears, Square Assistant, GDP AI, Search Fragmentation

Will Apps Improve ChatGPT Local?

OpenAI launched a GPT Store in January 2024. The idea was to make specialized GPTs available to large audiences and make ChatGPT more useful in specific contexts (e.g., writing, research, design). Some developers and publishers also saw it as a customer acquisition channel. It largely failed on both counts. This week at its Developer Day event in San Francisco, OpenAI announced "Apps in ChatGPT." Using an SDK, developers can bring a version of their apps directly into ChatGPT. Launch partners include Booking, Canva, Coursera, Figma, Expedia, Spotify and Zillow. Coming-soon apps include AllTrails, DoorDash, Instacart, OpenTable, TheFork, Tripadvisor, Thumbtack, Uber and a couple of others. Notice how many of these are local or substantially local. Apps in ChatGPT are invoked by either asking for the app directly ("Spotify, make a playlist") or ChatGPT may suggest apps "when they’re relevant to the conversation." For example, a search for real estate listings will trigger a branded icon and text such as, "use Zillow for this answer?" Depending on how many developers build apps for ChatGPT, this approach could help ChatGPT deliver a much stronger local search experience. While this is a clever strategy, there are many issues and contingencies. The program could easily meet the same fate as the GPT Store. But at least the potential for a much better and engaging local search experience is definitely there.

Americans 'More Concerned' about AI

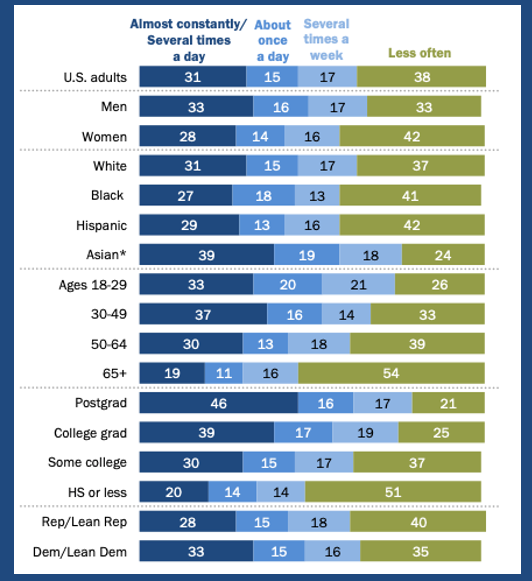

Since 2021 the Pew Research Center has been asking US adults whether they are "more concerned or excited" by the growing use of AI in daily life. For the past three survey waves "more concerned" has exceeded "more excited." More Americans are now saying the risks outweigh the benefits of AI. In 2025, 50% said they are more concerned than excited (down 1 point YoY), 10% said they are more excited than concerned and 38% are equally concerned and excited – so 48% have a partly or mostly positive view. A majority of survey respondents (57%) say AI's risks to society are "high," compared with 25% who say that the societal benefits are "high." Despite these concerns, 63% of adults (who interact with AI) said they do so at least "several times a week," with 31% engaging "several times a day." What constitutes an "interaction" is undefined; we assume it extends beyond ChatGPT or Gemini usage. Overall, 61% of people say they want "more control" over how AI is used, reflecting growing anxiety over AI penetration into daily life. The heaviest AI users in the survey were under 30 with more education. Men slightly outpaced women and Asian Americans led among ethnic groups. The big picture that emerges is of an ambivalent population that continues to adopt AI despite a number of serious concerns.

Square Operationalizes AI for SMBs

AI-powered insights and tools were the centerpiece of several product announcements from Square this week. The company first introduced Square AI earlier this year and is now integrating it throughout its product suite. Square describes its AI tool as a "conversational AI assistant that democratizes access to deeper business intelligence and makes Square the always-on partner for local businesses of all sizes." Square AI can deliver myriad data insights and access the internet "for local information and data related to weather, events, news, and reviews," which could implicate inventory and staffing decisions. Business owners and operators can also have deeper conversations with Square AI. The objective is to help business customers make smarter decisions, supported by contextual and transaction data. The company also introduced AI-powered voice ordering for restaurants. It answers customer calls and responds to questions, sending orders directly to the kitchen or POS. And there's a new social networking feature on its Cash App (Neighborhoods) that doubles as an online ordering and loyalty tool. Businesses can create branded storefronts that also appear on the open web. Square describes it as having mobile app functionality with out the hassle of building and maintaining one. Whether these features work as promised is an open question. But the announcements illustrate how most SMBs will "operationalize" AI – through trusted vendor relationships.

AI and the GDP Deception

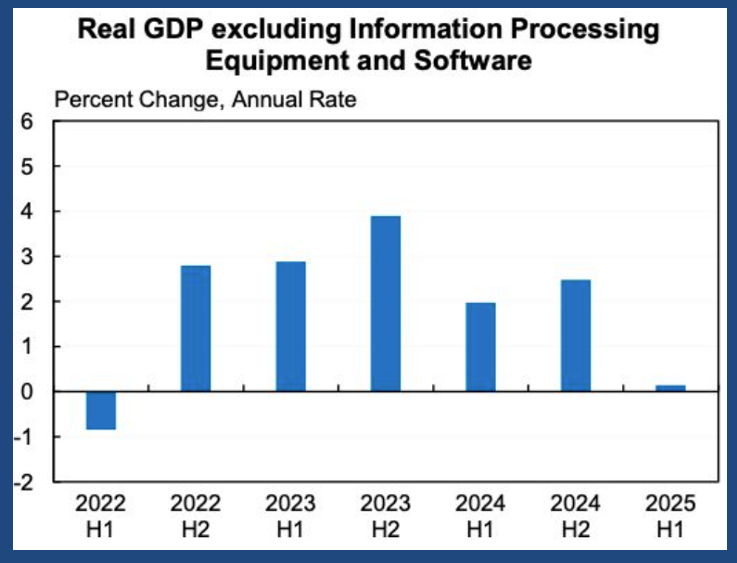

While job growth is stagnant and economic uncertainty is up, the stock market is booming and US economy appears to still be growing at a healthy clip. Many experts and economists are confused about these seeming contradictions. At bottom, there appear to be two factors driving the economy and GDP growth: affluent consumer spending and gaga AI investments. In fact, in the absence of AI spending, US GDP would have grown at an anemic 0.1% annual rate in the first half of 2025. There's a good deal of debate now about whether we're in an AI bubble, as well as comparisons between the current situation and the "dot-com" bust of the early 2000s. OpenAI's Altman and Jeff Bezos, among others, have explicitly stated we're in an AI bubble, but have tempered that assessment with statements about differences between today and the early internet. Regardless of your position on the historical parallel, what's fairly clear is that much of the money pouring into AI is not going to deliver a return to investors. Some of these investments will pay off in the long term. But one immediate question is how many AI companies will survive if investors lose confidence, and will that trigger a significant correction or recession?

'Search Fragmentation' Growing

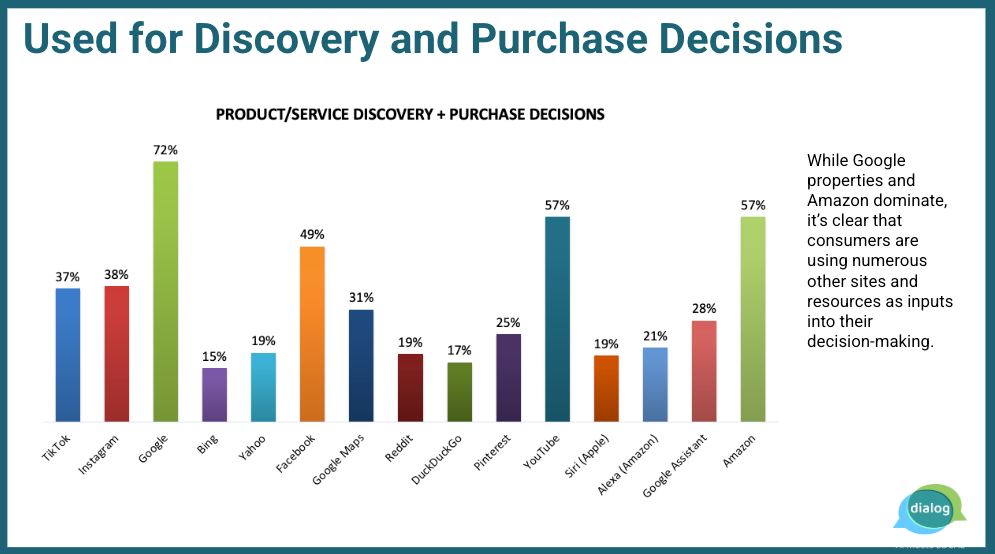

Smart marketers have always understood there are multiple online buying influences, with Google frequently dominating the bottom of the funnel (especially in local). Newly released data from a Q2 2025 Yext survey underscores what the company likes to call "search fragmentation." But it's not really a new phenomenon, except that the rise of TikTok, Reddit and ChatGPT have brought additional attention to the complexity of the customer journey. Yext found that "just 11% of U.S. consumers trust the first tool they use when searching online." It also found that 45% of US adults "start product research on a search engine," while AI is used by 15%. Beyond this, 45% of respondents said they used AI daily. For its part, social media is widely consulted for reviews, local recommendations and "how-to guidance." The big takeaway: people use multiple sites to make purchase decisions. The concept is simple, marketing execution is challenging. Where people specifically go will vary by purchase category, demographics and even device. What's actually new is AI's role in the "purchase funnel." Last November, we asked 1,000 US adults about which (non-AI) tools they used to make buying decisions. As you can see below, they were all over the place. In a local context, Google will likely continue to control the bottom of the funnel. But local marketers shouldn't focus exclusively on Google, or rely on assumptions about customer behavior. You need to understand what your ICP is actually doing.

Everything Else

- Transforming service businesses with AI may be harder than it looks.

- 79% of companies with significant AI adoption are hiring more.

- Motion Picture Assn. calls out OpenAI's Sora 2 for copyright violations.

- Google SMB AI training is really a stealth Gemini marketing program.

- Strong SEO and "GPT articles" helped improve AI visibility.

- An easy, low-tech way to track AI visibility.

- Use agent-friendly data formats (vs. HTML) to improve AI outcomes.

- ChatGPT appears to be prioritizing "answers" over branded websites.

- AI models need to be "disinfected" to fight global bad actors.

- Why is everybody so upset about "AI actress" Tilly Norwood?