What to Make of ChatGPT Checkout

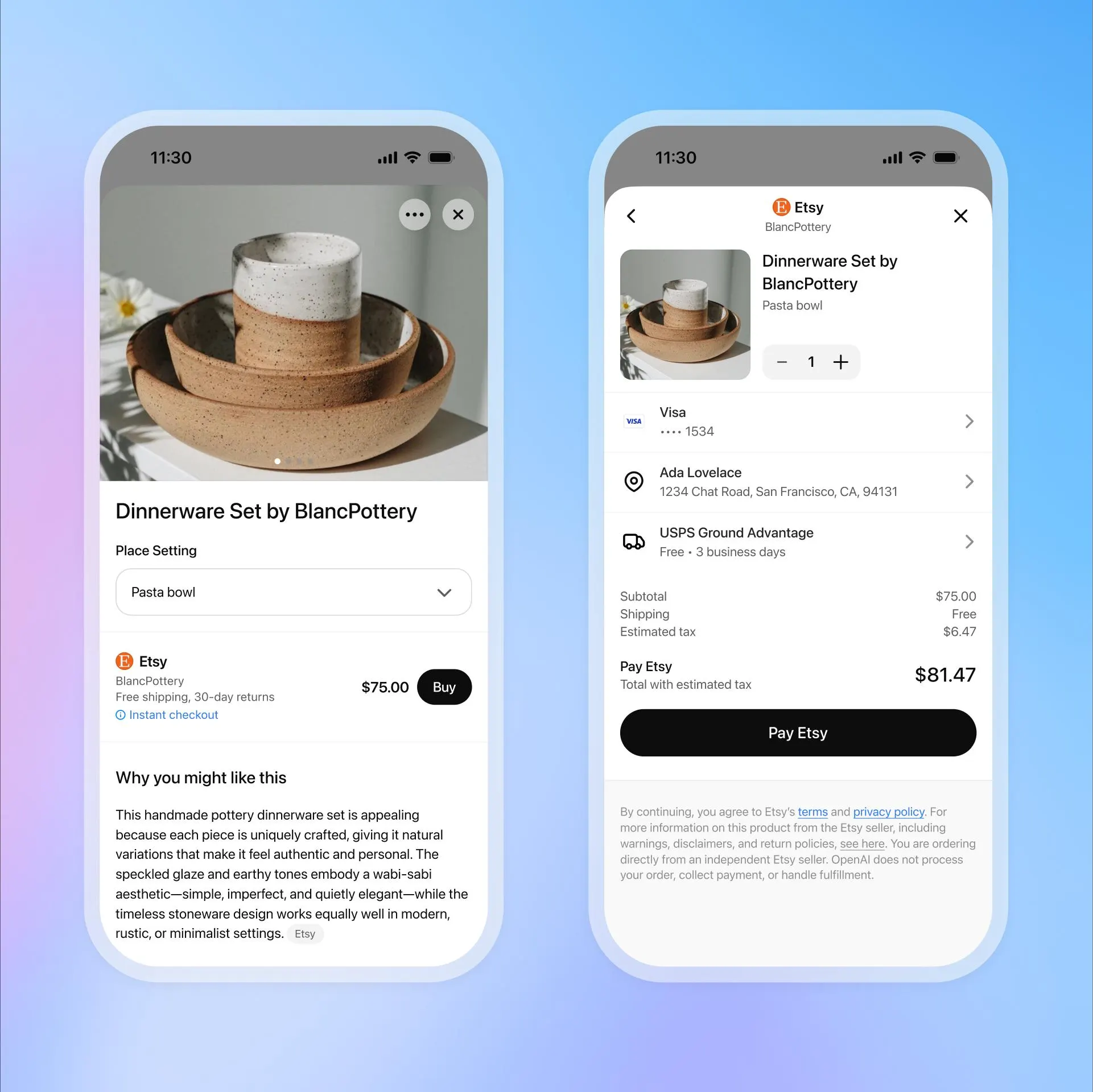

This week ChatGPT went live with Instant Checkout. We knew this was coming; it was previewed in a Financial Times report in July. Before that, in April, OpenAI announced an improved ChatGPT shopping experience with product images and buy buttons, taking users to a retailer checkout flow. With Checkout, you'll be able to buy items without leaving ChatGPT.

OpenAI's motivation is two-fold. Each transaction will bring a merchant fee, which at scale could represent a meaningful revenue stream for the company. OpenAI needs more revenue sources; it reportedly "burned" $2.5 billion in cash against $4.3 billion in sales in the first half. Checkout also signals the beginning of the "Agentic Commerce" era and supports OpenAI's larger ambition to replace Google and most other tools and platforms as the entry point for online content.

Perplexity has offered a specialized shopping and checkout experience for paid subscribers since November of last year. There has been some adoption but it's unclear whether the offering has any real traction. This will likely cut into it.

Product Research Is Popular

After the November 2022 launch of ChatGPT, many pundits quickly predicted Google would suffer a significant loss of search volume (see, e.g., Gartner) or be overtaken entirely. But Google is using all its market power, distribution and resources to avoid those outcomes. Multiple SEO tools now reflect that ChatGPT's traffic referral and search volumes are in the low single digits compared to Google's. And, in a pendulum swing, some digital marketers are now dismissing ChatGPT as anything more than a novelty whose impact is marginal at best.

While it's important to continue to focus on Google, especially as a local marketer, it would also be foolish to assume ChatGPT is not influencing buying decisions, although that may be less visible in analytics.

Product research is a popular use case on ChatGPT. Earlier this year, Yext surveyed consumers in four international markets, US, UK, France and Germany, and found that 45% of respondents used AI tools to research "product and service details." This compares with 70% who said they use Google, indicating an overlap.

In Dialog's June consumer survey (n=1K US adults) respondents were presented with 18 potential AI uses cases. Below are the top 10, with "product research and comparisons" at number 2:

- Answering general information questions

- Product research, comparisons

- Studying or learning

- Writing (emails, letters, content)

- Idea generation/problem solving

- Creative brainstorming and idea generation

- Work-related tasks (e.g., data analysis, summarizing documents)

- Travel research

- Creating images/videos

- Meal or recipe planning and prep

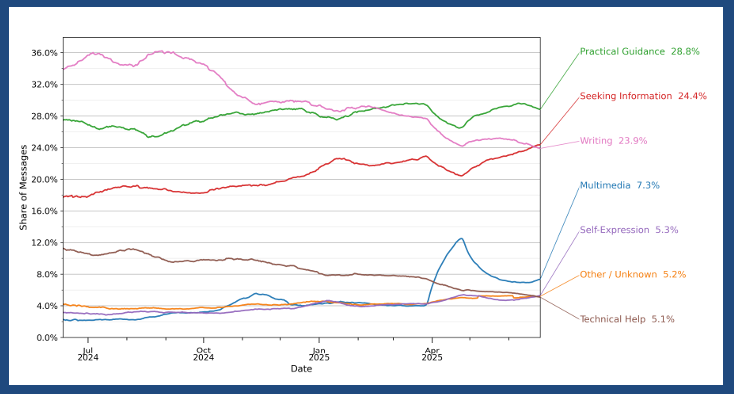

ChatGPT would not be pursuing shopping/product search if it wasn't seeing demand from its audience. Indeed, a report from ChatGPT and the National Bureau of Economic Research confirms this, finding that "Seeking Information" (search-like behavior) is the second most common use for the AI platform, with product research an unquantified subset of that category.

Agentic Commerce Protocol

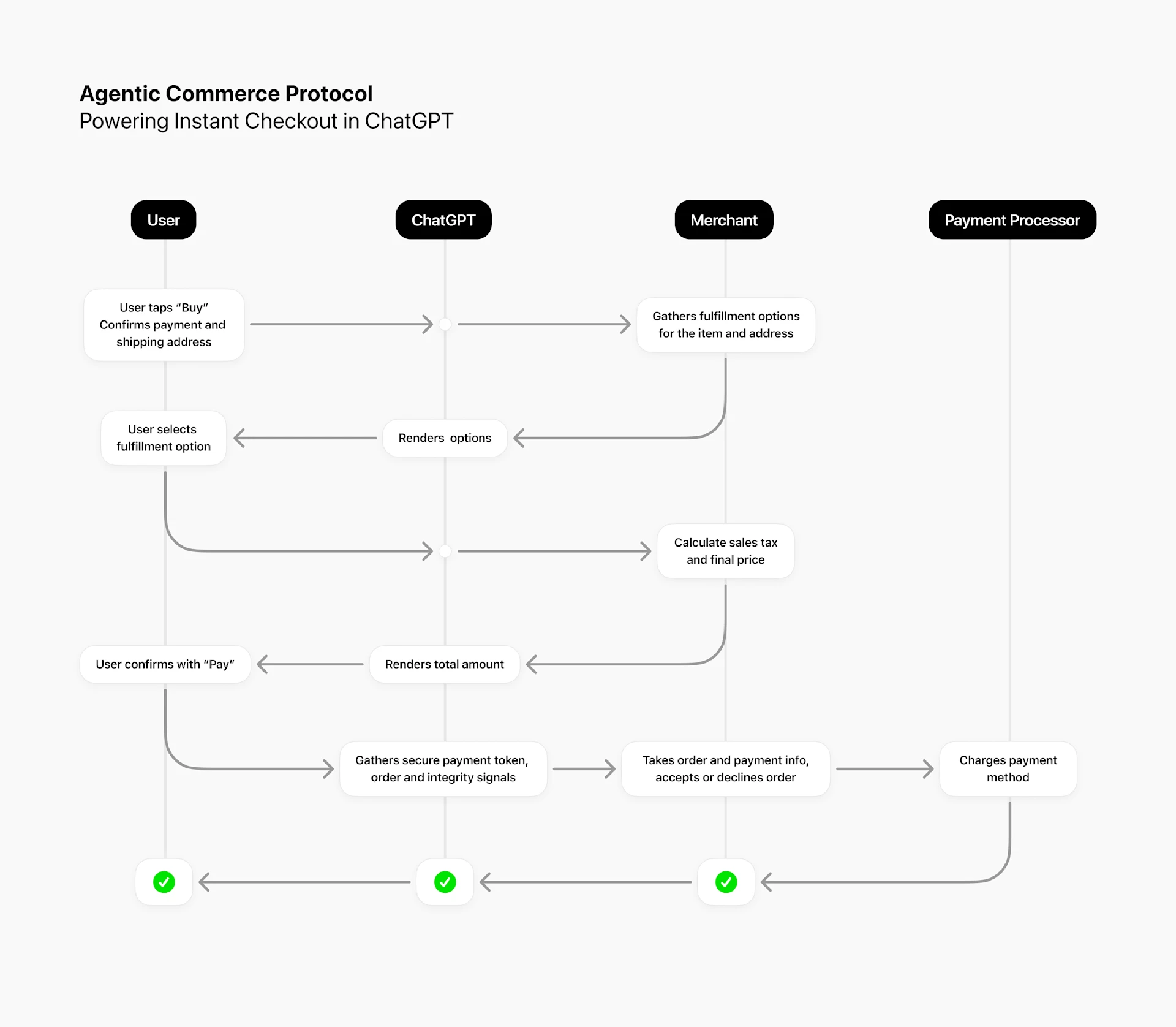

To launch Instant Checkout, OpenAI has partnered with Etsy, Shopify and Stripe in this initiative. The latter co-developed the payments infrastructure and "Agentic Commerce Protocol" with OpenAI. Etsy and Shopify will bring ChatGPT access to potentially millions of merchants globally, although OpenAI refers in its PR to "a million Shopify merchants ... coming soon."

While the inventory offered by the two marketplace partners – and maybe Stripe customers later – is significant, it's much less comprehensive than what Google, Amazon, Walmart and even eBay offer. To address this, OpenAI and Stripe developed the Agentic Commerce Protocol, which is being open-sourced to broaden and accelerate merchant adoption.

If this becomes a standard, it would potentially boost OpenAI's rivals as well. The Agentic Commerce Protocol relies on a structured product-data feed with product details and numerous additional attributes and fields. It appears more expansive and elaborate than Google's Merchant Feed. Thus it may put a greater data burden on merchants than Google's feed. That could mean they don't fully optimize their product data for ChatGPT.

Merchants may also choose to deliver a data feed but not participate in Checkout, which would send the consumer to their shopping carts to finish the transaction. The following are the product/shopping categories OpenAI is launching with:

- Arts, Media & Learning

- Automotive

- Beauty

- Fitness, Health & Wellness

- Electronics & Appliances

- Fashion, Jewelry & Accessories

- Home, Garden & Improvement

- Baby, Kids & Toys

- Pet Care

- Food & Beverage

- Travel

- Other (TBD)

What about Local Inventory?

The categories above will undoubtedly feature a percentage of merchants that have offline stores. That begs the question about display of local inventory.

Shopify does have offline inventory data, which has been used to support Local Inventory Ads on Google. Will ChatGPT present that information? It would be smart to, although the company's business model right now focuses on e-commerce related transaction fees.

Online consumers want access to local inventory data online. This has been the case for many years, although the data has been slow to appear. Very recent consumer survey data from Last Mile Retail show that AI users want to see local buying options when they do product research on ChatGPT. The survey asked, "Which of the following best describes how you use AI for local searching/shopping?" Among a list of multiple answers the top choice was, "I look for where to buy a product/item locally."

For those people who expressed mixed satisfaction or dissatisfaction with the AI local search/shopping experience, the survey asked what was missing? The absence of nearby store inventory was a prominent complaint.

OpenAI would do well to consider inclusion of local inventory data where it's available, despite the fact that its model doesn't seem to contemplate local shopping. It's something consumers clearly want.

What about Advertising?

OpenAI CEO Sam Altman famously doesn't like ads. However, the company has begun hiring people to generally support advertising on ChatGPT.

OpenAI said that "ChatGPT shows the most relevant products from across the web. Product results are organic and unsponsored, ranked purely on relevance to the user." For the time being, then, no ads will appear.

Product ads are a natural fit and will simply be too much of a temptation, especially if ChatGPT shopping scales. So it's almost certain that product-related advertising will be introduced at some point. OpenAI needs the money.

Impact on Competitors

This brings us to the inevitable and difficult question of whether ChatGPT shopping/Checkout will succeed and how that might impact competitors.

Almost every time Google introduced a new product line or feature, in the past, it was dubbed a "[ ] killer." The assumption was that simply because Google had introduced the product it would replace whatever third party offering was already in the market. In some cases that actually happened, think Google Maps vs. Yahoo Maps or Mapquest. But most of the time it didn't happen; and in many cases Google retired these products because they didn't scale quickly enough.

ChatGPT will likely have some measure of success, but will it simply be another buying option or will it rival major online shopping destinations like Amazon and Walmart? Execution and the user experience matter. Certainly the potential for success is there. But six months from now we'll have a better sense.

Amazon and Walmart aren't currently using the company's Agentic Commerce Protocol, although ChatGPT product comparisons do return Amazon and Walmart buying options. Large retailers like these will be ambivalent or hostile to ChatGPT owning the checkout experience and may never adopt the protocol.

Because of its brand strength and customer loyalty, chiefly because of Prime, Amazon has few incentives to participate unless Checkout becomes a breakout success. Google can't participate because it's not a retailer, although it could embrace the protocol for its merchant feeds.

Google tried to host its own checkout flow in 2006, which it subsequently abandoned. Today, Google has a much larger "product catalog" than ChatGPT and will probably remain strong in product search. It's also the only online destination, other than retailer websites, that offers (some) local inventory.

Google is also starting to develop its own agentic shopping experiences and will seek to preempt ChatGPT to prevent it from gaining traction in shopping. Retail/product search is one of Google's major advertising drivers and losing traffic in this category has ad-revenue implications.

For their part, retailers could suffer if ChatGPT shopping/Checkout is a success, reducing them to interchangeable product sources. There are many potential responses, which could include both direct participation and defensive strategies. Retailers with local stores and multi-channel buying options will need to play up that angle, as well as improve loyalty programs and direct buying incentives.

It will be interesting to watch how widely the Agentic Commerce Protocol is adopted and how that impacts "agentic commerce" beyond ChatGPT. At this point the likely scenario for ChatGPT is that it becomes just one more e-commerce shopping destination on the internet.